What to Know About Uninsured Motorist Coverage

Driving in Florida comes with its share of risks, especially since many people on the road don’t have insurance. As of June 2024, about 6.37% of drivers, or 1,038,246 out of 16,306,173 registered vehicles, are uninsured in Florida. This highlights how important it is to know about uninsured motorist coverage. Understanding this coverage can help protect you from financial trouble if you’re ever in an accident with someone who doesn’t have insurance.

What is Uninsured Motorist Coverage?

Uninsured Motorist (UM) Coverage is a type of auto insurance that protects drivers from the financial burden of accidents involving uninsured or underinsured drivers. Despite legal requirements, not all drivers carry insurance, and those who do may have insufficient coverage to handle the costs of an accident. UM coverage steps in when the at-fault party either has no insurance or lacks adequate insurance to help pay medical bills, lost wages, and other damages resulting from the accident.

This type of insurance coverage essentially acts as a safety net, providing the insured with compensation for injuries, pain and suffering, and property damage that would have otherwise been covered by the at-fault driver’s insurance. UM coverage is important because it ensures that you are not left financially vulnerable due to someone else’s lack of responsibility.

Additionally, Uninsured Motorist Coverage can include both Uninsured Motorist Bodily Injury (UMBI) and Uninsured Motorist Property Damage (UMPD). UMBI covers medical expenses and other injury-related expenses, while UMPD helps repair or replace your vehicle or other property damaged in the accident.

Who Does Uninsured Motorist Insurance Cover?

Uninsured Motorist Insurance covers not only the policyholder but also extends its benefits to others involved in the accident under certain conditions. Typically, UM coverage applies to:

- The Policyholder: The primary insured is covered for injuries and damages incurred in an accident caused by an uninsured or underinsured driver.

- Family Members: Family members residing in the policyholder’s household are often included under the UM coverage, whether they are passengers in the insured vehicle or pedestrians involved in an accident with an uninsured driver.

- Passengers: Any passengers riding in the insured vehicle at the time of the accident can also be covered under UM insurance for their injury-related expenses.

- Policyholder in Other Vehicles: If the policyholder is driving a different vehicle that they do not own but have permission to use, UM coverage may still apply.

- Hit-and-Run Victims: In a hit-and-run accident where the at-fault driver cannot be identified or located, UM coverage can provide compensation for injuries and damages.

Which States Require Uninsured/Underinsured Motorist Coverage?

While Uninsured/Underinsured Motorist (UM/UIM) coverage is highly recommended, its requirement varies by state. Some states require UM/UIM coverage as part of their auto insurance regulations, while others make it optional. Here’s a look at the requirements across different states:

- Mandatory Coverage States: Connecticut, District of Columbia, Illinois, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Oregon, South Carolina, South Dakota, Vermont, Virginia, West Virginia, Wisconsin

- Optional Coverage States: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Indiana, Iowa, Kentucky, Louisiana, Michigan, Mississippi, Montana, Nevada, New Mexico, Ohio, Oklahoma, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Washington, Wyoming

It’s important to check your state’s regulations and your insurance policy to understand whether you’re required to carry UM/UIM coverage. Opting for UM/UIM coverage even in states where it’s not mandatory can provide peace of mind and financial security against the unexpected costs of an accident with an uninsured driver.

Types of Uninsured Motorist Coverage in Florida

In Florida, insurance companies offer Non-Stacked and Stacked Uninsured Motorist (UM) Coverage to help drivers protect against accidents involving uninsured or underinsured drivers. Both options offer different features and benefits to meet individual insurance needs.

Non-Stacked Uninsured Motorist Coverage

Non-Stacked Uninsured Motorist (UM) Coverage is the more affordable choice for drivers who want basic protection against uninsured or underinsured motorists. This coverage applies specifically to vehicles listed on your insurance policy.

When occupying these insured vehicles, you are covered up to the UM limit shown on your policy. This limit represents the maximum amount you can collect, with no additional benefits extending to other vehicles. Non-stacked UM coverage is ideal for those who drive only their personal vehicles and are looking for cost-effective insurance.

Stacked Uninsured Motorist Coverage

Stacked Uninsured Motorist (UM) Coverage offers enhanced and flexible protection. Unlike non-stacked UM, stacked coverage not only applies to vehicles listed on your policy but also extends to vehicles not listed, such as a company vehicle. Importantly, it also covers you while riding motorcycles, an area where non-stacked UM does not provide protection.

The coverage limits on your policy can be multiplied based on the number of vehicles insured. For example, if you insure two cars, your coverage limit is effectively doubled. Although stacked UM is more expensive, its higher limits and broader scope make it a comprehensive option for those who drive multiple vehicles or motorcycles and require extensive coverage.

How Much Uninsured Motorist Coverage do I Need in Florida?

Under Florida’s No-Fault Law, Florida drivers are required to carry at least $10,000 in personal injury protection (PIP) and $10,000 property damage liability (PDL) coverage. However, these minimum requirements might not be sufficient in an accident involving an uninsured or underinsured driver. For even more financial protection, it’s wise to consider adding uninsured motorist (UM) coverage to your policy.

When deciding on the amount of UM coverage, you should consider these factors:

- Match Your Liability Coverage: Align your UM coverage with the liability limits on your auto policy. If you have $100,000 per person and $300,000 per accident in liability coverage, aim for similar UM limits to ensure equal protection.

- Evaluate Financial Assets: Consider your savings, property, and income. Higher UM limits may better protect these assets from substantial financial losses in the event of a serious accident.

- Consider Driving Habits: If you frequently drive in high-traffic areas or areas with many uninsured drivers, UM coverage becomes even more important. Also, higher coverage can provide better protection for any passengers you regularly carry.

- Balance Coverage with Budget: While higher UM limits offer greater protection, they also result in higher premiums. Determine what level of coverage provides a good balance between sufficient protection and affordability.

Contact Our Experienced Personal Injury Lawyers

If you’ve been involved in an accident with an uninsured driver, our team at Fine, Farkash & Parlapiano, P.A. is here to help. Our experienced personal injury lawyers can guide you through the intricacies of insurance claims and ensure you receive the compensation you deserve. Contact us today for a free consultation to discuss your situation and let us provide the expert assistance you need to protect your financial well-being in the event of a car accident.

Sources:

Uninsured Motorist Rate | Florida Highway Safety and Motor Vehicles

627.7407 Application of the Florida Motor Vehicle No-Fault Law. | The Florida Legislature

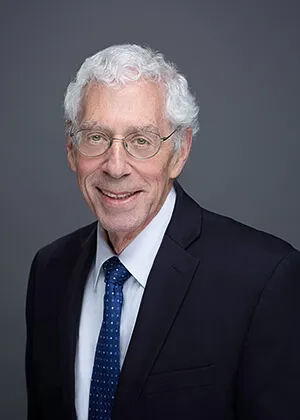

Mr. Fine was born in New York, New York, and was raised in the northeast, where he studied sociology at Colby College in Waterville, Maine. He then graduated with honors from the University of Florida Levin College of Law in 1976. In law school, he was a member of Phi Kappa Phi Honor Society, was inducted into the Order of the Coif, and graduated in the top 10 percent of his class. Mr. Fine was admitted into the Florida Bar in 1976, the United States District Court for the Middle District of Florida in 1977, the United States District Court for the Northern District of Florida in 1991, and the United States Court of Appeals 11th Circuit in 1982.